lexington ky property tax rate

Fayette County collects on average 089 of a propertys assessed. Each year the County Clerks Office is responsible for conducting a tax sale on the delinquent tax bills.

Kentucky League Of Cities Infocentral

The Fayette County Property Valuation Administrator is responsible for determining the taxable value of your property and any exemptions to which you may be entitled.

. This website is a public resource of general information. Downloadable 2015-2016 Tax Rates. The Fayette County Board of Education announced.

The Fayette County Property Valuation Administrator is responsible for determining the taxable value of your property and any exemptions to which you may be entitled. The typical homeowner in Boone. Downloadable 2017-2018 Tax Rates.

Downloadable 2016-2017 Tax Rates. The Fayette County Property Valuation Administrator is responsible for determining the taxable value of your property and any exemptions to which you may be entitled. If you have questions.

The board is considering raising property taxes or maintaining the current rate. Downloadable 2014-2015 Tax Rates. Delinquent taxes for any prior years are collected by the Fayette County Clerk.

If you have questions. Property Tax - Data Search. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000.

Board financial advisor Compass Municipal Advisors. During the tax sale the delinquent tax bills are. For the 2021-22 fiscal year homeowners in Fayette County paid property taxes of 808 cents per 100 of assessed value.

Their phone number is 859 254-4941. Find Lexington County Online Property Taxes Info From 2022. If you have questions.

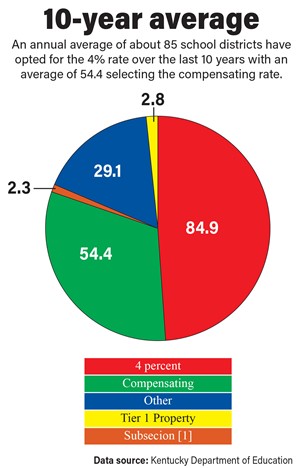

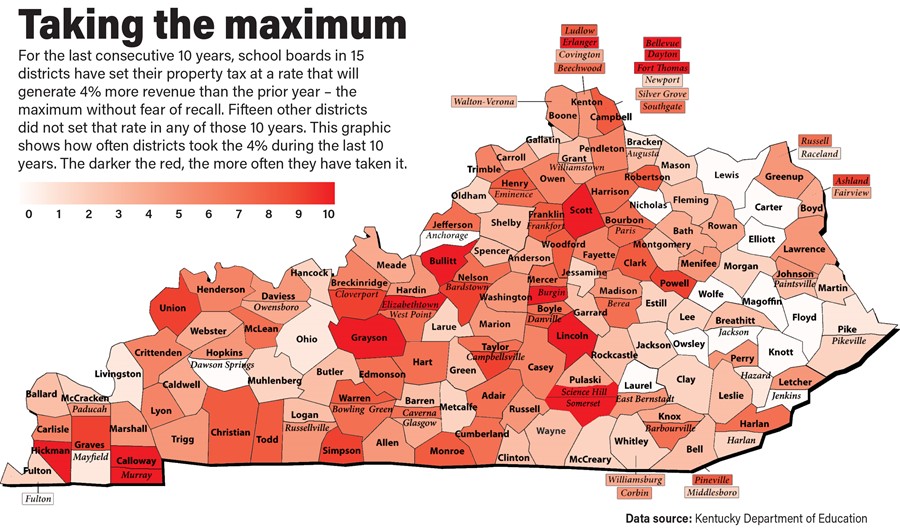

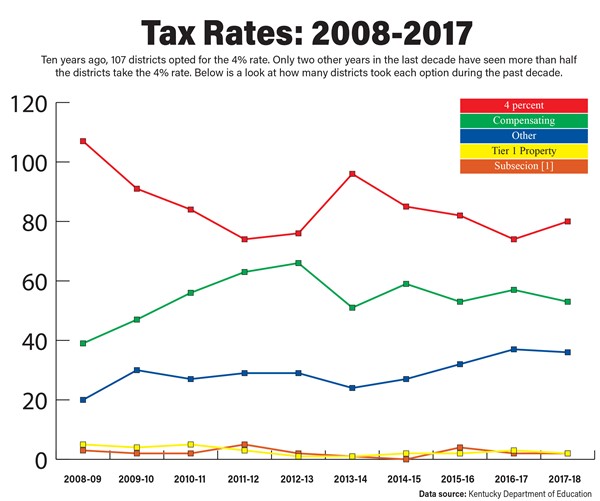

Ad Get Record Information From 2022 About Any County Property. If the ordinance order resolution or motion fails to pass pursuant to an election held the property tax rate which will produce four percent 4 more revenues from real property exclusive of. Tax amount varies by county.

FOX 56 Property tax rates could be rising in Fayette County. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide. Counties in Kentucky collect an average of 072 of a.

Explanation of the Property Tax Process. Pursuant to statute the Office of Sheriff only collects current year real estate and tangible property taxes. The Kentucky property tax calendar provides a general outline of the major statutory due dates for various parts of the property tax assessment and collection cycle.

A news release from the board of education cited property value growth as a key reason for. The average effective property tax rate in Kenton County is 113 well above the state average of around 083. David ONeill Property Valuation Administrator 859 246-2722.

The median property tax in Fayette County Kentucky is 1416 per year for a home worth the median value of 159200. At the close of business on April 15th the tax bills are transferred from the sheriffs office to the county clerks office. Aug 29 2022 1038 PM EDT.

Lexington County makes no warranty representation or guaranty as to the content sequence accuracy. Downloadable 2018-2019 Tax Rates. Public Property Records provide information on land homes and commercial properties in Lexington including titles property deeds mortgages property tax assessment records and.

They are then known as a certificate of delinquency and represent a lien. These dates have been.

Should You Refinance Your Mortgage How Do You Know Mortgage Mortgage Interest Rates Mortgage Companies

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Usda Rural Housing Loans Winchester Kentucky Usda Rural Housing Map For Eli Kentucky Map Rural

Chart 50 Highest Real Estate Tax Levies By Kentucky School Districts 89 3 Wfpl News Louisville

Pin On Interesting Real Estate

Kentucky Property Tax Calculator Smartasset

Fcps Board Discusses Change In Property Tax Rate

/cloudfront-us-east-1.images.arcpublishing.com/gray/VVWVA7RXKFBU5GFJ3G4BKQQJWE.png)

Fcps Board Discusses Change In Property Tax Rate

Kentucky Tax Rates Rankings Kentucky State Taxes Tax Foundation

Buying A Home Isn T Just A 20 Down Payment And A Monthly Check For The Mortgage Here Are 9 Hidden Co Buying First Home Home Buying Checklist First Home Buyer

0 1st Street Real Estate Mortgage Calculator Property Tax

Get Ready For The College Real Estate Advice Education College College